More than a year ago I pondered How Does Blockchain Affect SEO? These days blockchain is affecting the world of art and has implications for major art auction houses.

In February 2021 the artist Beeple sold a digital video for $6.6 million at Nifty Gateway, an online cryptocurrency marketplace for digital art. Now artists, collectors and auction houses are scrambling to find answers.

- What is NFT crypto art?

- How will NFT impact buying, collecting, and selling artwork?

- Will blockchain disrupt the fine art auction industry?

- What does blockchain have to do with buying and selling art?

- How does NFT benefit artists?

Click to Read Sections:

What is an NFT?

NFT is short for “non-fungible token”. It’s a unique digital asset authenticated by blockchain technology. ‘Non-fungible tokens are virtual items that use blockchain technology and smart contracts to assure each item, or asset, is unique and unchangeable.

For example, NFTs can be linked to digital photos, videos, virtual trading cards in video games and even digital artwork. While digital items, such as photos, can be copied indefinitely, NFTs cannot, as each is immutably unique, creating scarcity in the virtual assets to which they are linked. As Wikipedia puts it,

“Emerging as a niche genre of artistic work following the development of blockchain networks such as Bitcoin and Ethereum in the mid to late 2010s, crypto art quickly grew in popularity in large part because of the unprecedented ability afforded by the underlying technology for purely digital artworks to be bought, sold, or collected by anyone in a decentralized manner.”

Unlike crypto-currencies, each NFT is unique and acts as a collector’s item that can’t be duplicated, making them rare. Thanks to the Ethereum blockchain, artists and content creators can use digital tokens to ensure ownership and provenance of unique assets. Turning art into a digital asset proves authenticity, enables reproduction without devaluing the original, and opens up a whole new revenue model for artists.

Is NFT art a fad?

It’s not new, nor is it a fad. According to Forbes, “Three years ago, the entire NFT market was worth no more than $42 million. By the end of 2020, it had grown 705% to $338 million in value, according to the latest estimate from Nonfungible.com, which monitors the NFT marketplace.”

In fact, the first live NFT auction was held in New York City in January 2018, says Vice. “While live auctions in the traditional art world follow rigid rules and demand demure behavior from bidders, the first ever live auction for rare blockchain art got rowdier as the bidding went on.”

CNBC reports that Mark Cuban is getting in on NTF: “Even Mark Cuban and other celebrities are cashing in on the NFT craze. The billionaire Dallas Mavericks owner has auctioned digital goods online and owns some himself.” The same February 2021 article goes on,

“The total value of NFT transactions quadrupled to $250 million last year, according to a study from NonFungible and L’Atelier. The number of digital wallets trading them almost doubled to over 222,179, while some traders were able to make profits of over $100,000.”

Here are examples of NFT crypto art sales:

- Beeple sold a single $69 million NFT artwork at a Christie’s auction.

- Film and video game artist Ben Mauro recently released an NFT crypto art project called “Evolution.” The digital card packs sold out in seven minutes and generated $2 million in sales.

- Chris Torres, the artist who first created Nyan Cat, recently ‘minted’ a new GIF of the famous internet meme which sold for over $470,000 worth of the Ethereum cryptocurrency in February 2020.

- A 10-second video created by digital artist Beeple recently sold for $6.6 million in an art auction.

- In February 2021 the artist Beeple sold a digital Nylan rainbow cat video for $6.6 million at Nifty Gateway, an online cryptocurrency marketplace for digital art.

- Mad Dog Jones recently set a record for $3.9 million worth of art sold in one sale, topping the previous record held by Beeple for his $3.5 million “Everydays 2020 Collection” drop.

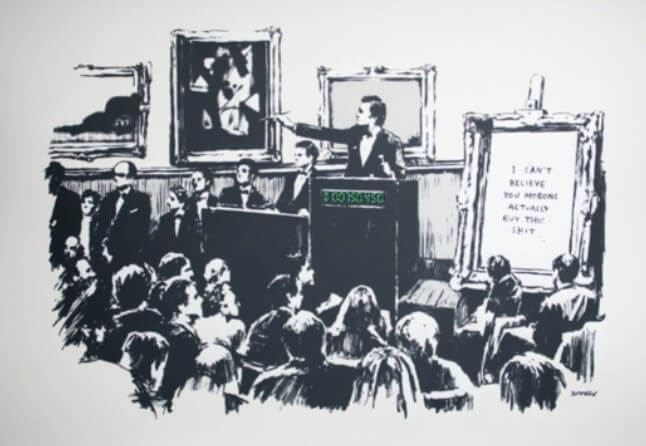

- Blockchain company buys and burns Banksy artwork to turn it into a digital original. A blockchain company bought a $95,000 Banksy artwork, burned it, and broadcast it live on Twitter — all part of a process of turning the work into a virtual asset called a non-fungible token, or NFT.

How Does Selling an NFT Benefit the Artist?

Selling original artwork on a crypto exchange means the artist is in control of selling his or her own artwork, meaning no dealers. Artists can sell the digital art to a single buyer, or sell a limited number of “digital prints”. A CNN article also pointed out:

“And there’s another benefit for digital artists: They can continue making money on their work, even after it has been sold. NFTs can allow creators to receive a cut on all future transactions — on Nifty Gateway, this is typically set at 10% — breaking with the centuries-old model whereby artists do not directly benefit when sold works grow in value over their lifetimes.”

Background – What is Blockchain?

Blockchain is just a distributed database design that ensures authentication and ownership. Blockchains work with tokens, and a token can represent a unit of cryptocurrency, digital art, or even equity ownership of a company. As I put it in another article on blockchain and SEO,

“It’s confusing because blockchain is so closely tied to Bitcoin. Bitcoin and Ethereum are virtual currencies that use blockchain. Specifically, blockchain is a distributed ledger database. Blocks of data save transactions (records of anything) in a chronological chain, then the blocks are sent to other computers hosting the same ledger. Secure access keeps it safe, chronological blocks keep records accurate, and distributing the ledger keeps it decentralized and trusted.”

Tod Lock

How to buy NFT digital art

So far buying NFT crypto art hasn’t been easy, says TechCrunch:

“The vast majority of NFT platforms today require users to be familiar with Ethereum wallets like MetaMask. This means collectors need to purchase ETH from an exchange like Coinbase and send it to a non-custodial address that consists of a long string of numbers and letters to get started. Once they’re there, they need to pay upwards of $100 worth of fees to make a transaction and place a bid.”

Where can you buy NFT crypto art?

Collectors can purchase NFTs from marketplaces, or via auction. Either way, the crypto art resides on the blockchain, and the buyer is getting sole ownership of that asset.

NFT Marketplaces:

NFT Auction Houses:

- Christie’s has conducted auctions of NFTs, but has not had a dedicated event yet.

IRS tax implications of investing in NFTs

With NFT sales exploding in the hundreds of millions of dollars just in the past few weeks, maybe it’s no surprise that the IRS has reared its head. According to a CNBC article,

At issue is recent IRS guidance on using cryptocurrencies to buy an asset, including an NFT. As part of its principle known as “disposition of assets,” the IRS states that “if you exchange virtual currency held as a capital asset for other property, including for goods or for another virtual currency, you will recognize a capital gain or loss.”

Shehan Chandrasekera, head of tax strategy at CoinTracker

The IRS doesn’t consider BitCoin and Ethereum to be currency; but rather an asset. For example, a buyer might be subject to capital gains tax of 20% if the cryptocurrency he used to purchase the NFT appreciated in his digital wallet. If a seller flips the NFT for a profit, she’d be subject to a 28% tax bill for collectible capital gains.

The net effect is that both buyers and sellers of NFTs may face tax bills they didn’t consider when investing in NFTs.

How will NFT crypto art affect art auction houses?

This dire headline appeared in Input Magazine: Crypto art exchanges are about to blow up the auction house. Are art auction houses doomed? The article says about the first ever auction for NFT crypto art, “While live auctions in the traditional art world follow rigid rules and demand demure behavior from bidders, the first ever live auction for rare blockchain art got rowdier as the bidding went on.”

In October 2020, Christie’s was the first major auction house to hold a NFT auction, where a digital ‘portrait’ of Bitcoin Creator Satoshi Nakamoto sold for $131,250. In February 2021 Christie’s is auctioning a NFT from Beeple, this time with a $100 opening bid, according to The Art Newspaper,

“The winning bidder will receive an encrypted file without any kind of physical presence, and the transaction will be registered on the blockchain. Crucially, unlike the traditional art world, the provenance for all NFT purchases are public, immutable and available on the blockchain.”

Can You Lose an NFT?

NFTs include information on where you can find the artwork they represent, but the actual artwork is still linked to where it’s hosted. But what if the link breaks? What if the hosting company or website operator goes out of business? What if the server hosting the digital artwork is hacked with ransomware?

A system called IPFS, or InterPlanetary File System, can help when used because it finds the content across a network of IPFS sites. Otherwise, one dead hard drive means an owner could lose his NFT forever.

Or according to The Verge,

“Like a painting, NFTs need to be maintained. If a buyer purchases an NFT that relies on IPFS, it’ll ultimately be on them to ensure the file continues to be hosted and available to the system.”